Held fast by thousands of years of social bonds, interpersonal lending still flourishes in China’s countryside

When Lin Meiying (pseudonym) began to save up for her daughter’s dowry in the early 2000s, she deposited the girl’s earnings from her factory job in three different rural credit cooperatives (RCCs): one in her own village, and two in neighboring villages several kilometers away.

Though the sum was not a big one—just several thousand RMB—the then 40-year-old farmer from Hengyang, China’s central Hunan province, had good reason for her strategy, even if it meant making several trips to withdraw the money. “If I kept it in one RCC, everyone would know about it, and then they would come to borrow from me,” Lin explains.

Despite her best efforts, word of Lin’s savings got out, and a relative came to ask for a loan. This is normal among Lin’s acquaintances and in rural regions all around China, where bonds of kinship and mutual obligation have sustained informal networks of borrowing and lending for thousands of years.

Lin’s family had borrowed from relatives and neighbors to build houses in the 1980s and 1990s. In return, they lent money to these acquaintances to finance their weddings, house construction, and children’s education.

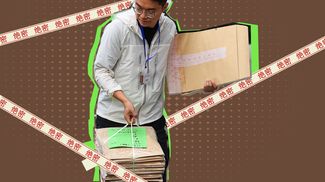

According to Lin, the borrowed money usually changes hands without a contract, IOU, or interest, since most people in her circle “are too embarrassed to bring up such matters.” Instead, the parties verbally agree on a repayment date, or the borrower may simply promise to return the money as soon as they can.

Over the last three decades, despite the rapid growth of China’s formal financial sector, borrowing and lending among private individuals has continued to be the dominant mode of financing in rural areas. This is known as informal credit, as the loans are between individuals, business entities, and organizations other than banks and government-registered financial institutions.

In 2019, based on a survey of 3,622 households from around 100 villages across the southeastern Guangdong province, a research team from the Institute for Economic and Social Research at Jinan University found that 90 percent of over 500 households that borrowed in the last year got the money from relatives and friends, while only 5.8 percent borrowed from banks and other registered financial institutions.

Private borrowing is usually more convenient and faster than a bank loan. Traditional social obligations also play a role. In Lin’s memory, she and her husband have never refused to lend to any relative or neighbor in need if they had any means to help—even if it meant taking money out of their own savings. “[If we refused], it would be awkward if we met them afterward,” Lin says, noting that most families in the village have been acquainted for many generations (if they aren’t already distant relatives).

It’s also considered gauche to urge the borrower to repay, unless the lender is in real need. “It’s tougher to be a lender [than a borrower],” Lin sighs, though she says that most people in her village return the money as soon as they can.

Still, informal and personalized lending puts vulnerable lenders and borrowers at huge risk of defaults, disputes, or even lawsuits. The situation has been complicated by the difficulty and high cost for rural Chinese to get formal loans, or even find a bank close to their home, despite the government’s efforts to promote rural finance.

Though known as a “nation of savers,” Chinese society has a long tradition of informal borrowing and lending. Professor Luo Jianchao, director of the Institute of Rural Finance at China’s Northwest A&F University, believes the practice persists in the countryside because it is deeply rooted in the traditional structure of Chinese society.

As sociologist and anthropologist Fei Xiaotong described in his book From the Soil: The Foundations of Chinese Society, China’s traditional agrarian society is based on guanxi—kinship and other social relationships. Farming families bound to the land don’t need contracts when they have been giving and returning favors to one another over hundreds of years. “Living in the same place generation after generation, villagers know each other well, so they are afraid of damaging their reputation if they fail to repay a loan,” says Luo.

However, the social obligation is no guarantee of repayment, and the communal bonds are in danger of breaking down as families move away from the village and absorb new values from the cities. Lin tells TWOC that it took her family around 10 years to recover a few thousand RMB they lent to a cousin in the 90s, and wishes they had put the money in a high-interest savings account instead.

Chen Zhenwen, a 58-year-old farmer from a neighboring town, still hasn’t gotten back the 1,000 RMB he lent to a former classmate in the 80s—money he had borrowed himself from several relatives. At that time, the money was almost enough to build a small house for him and his wife. “He promised to repay soon each time we met, but never did, until he eventually skipped town,” says Chen, who then had to pay back his own relatives bit by bit.

Cases like Chen’s are on the rise. According to the Supreme People’s Court, China’s judicial system ruled on over 590,000 cases related to informal lending in 2011, and over 1 million cases in 2014, with an average annual increase of around 20 percent.

Borrowers and lenders involved were often relatives, neighbors, classmates, and other social relations. Some wrote a simple IOU or receipt, but few signed a contract. The lack of evidence on both sides of the dispute causes many administrative headaches for courts, especially if the dispute turns violent and leads to criminal prosecution.

In addition to culture, a lack of formal financing services in rural China plays a role in the persistence of informal financing. In a survey of nearly 100,000 individuals from 28,151 households in 2013, a research center from Southwestern University of Finance and Economics found that the accessibility rate of private lending and formal loans in rural areas were 67.4 and 23 percent, respectively, while the respective rates in cities were 32.9 and 65.9 percent.

Financial institutions are few and far between in the countryside. In the town closest to Lin’s village, there are three banks serving a population of over 69,000 in an area of almost 150 square kilometers. Many small towns have no banks at all.

From 1998 to 2002, four major state-owned commercial banks—the Agricultural Bank of China (ABC), Bank of China (BOC), Construction Bank of China (CBC), and Industrial and Commercial Bank of China (ICBC)—closed nearly 20,000 branches in rural counties in the economically under-developed middle and western regions of China due to low operations and high costs; the rural-oriented ABC alone closed 15,000 branches.

Many of the remaining branches were authorized to accept deposits only but not issue loans, as the banks wanted to encourage deposits in the countryside to fund higher-return investments in the cities. “This is a product of China’s dual economy system, which prioritizes urban and industrial development over that of rural areas and agriculture,” Professor Luo explains.

Following the United Nations’ financial inclusion initiative in 2005, China has campaigned to make financial products and services accessible and affordable to all individuals and businesses, including farmers, small businesses, low-income urbanites, the poor and disabled, and the elderly. The government encouraged the establishment of village and town banks, loan companies, rural mutual cooperatives, and micro-loan companies in rural areas. Based on information from the World Bank’s Global Findex Database, close to 190 million Chinese adults got their first bank account between 2011 and 2017, increasing the country’s “banked” population from 58 percent to 79 percent of the total adult population.

However, it is still challenging for farmers to get loans. “They lack the documents to prove that they have the right to use their lands. Most major banks will not provide loans to them because of the lack of collateral,” Dou Benbin, a risk management officer at the Shanghai Minhang BOS Rural Bank, explains to TWOC.

The fact that agriculture is more vulnerable to the unpredictable impact of adverse weather or natural disasters may further increase the repayment risk. Data from the Dalian Rural Commercial Bank showed that its ratio of bad loans increased from 4.95 percent in 2017 to 9.95 percent in 2018, after a series of natural disasters in the area.

Meanwhile, as Professor Luo has discovered during his research on rural financial services in northwestern China, while farmers complain about the difficulty of obtaining loans, financial institutions say they have trouble finding rural borrowers. According to Dou, some RCCs and banks would persuade farmers who don’t want to borrow to accept a micro-loan, ranging from 3,000 to 50,000 RMB, to meet targets set by local authorities for rural financing.

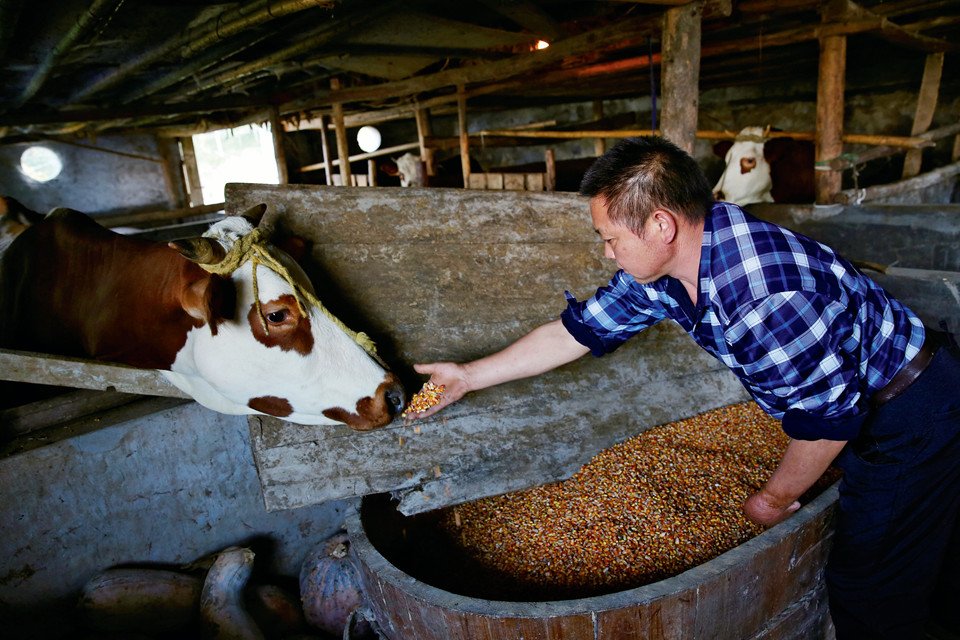

Over the last decade, Professor Luo and his team have been working with the government and financial institutions to find solutions to some of the issues, including offering land-use rights and biological assets such as livestock as possible collateral for rural borrowers.

Having noticed similar issues in Britain’s rural areas four or five decades ago, he believes these financing issues can be resolved as China develops economically. “It’s a long process,” he says.

Chen still feels hurt when he remembers his classmate’s betrayal years ago. “We studied in the same classroom for years,” he grumbles. Though the experience taught him to be more cautious when lending out money, he hasn’t lost faith in informal lending. “There are always dishonest people, but they are in the minority.”

All images from VCG

It Takes a Village is a story from our issue, “Dawn of the Debt.” To read the entire issue, become a subscriber and receive the full magazine.